Fraud prevention

In case of loss, misplacement, robbery, theft or misappropriation of access data to the Eupago plataform, or suspicion of fraud, the Eupago account holder must immediately notify Eupago through the fastest means, without any undue delay, and transmit all the information they have.

The communication must be addressed to the person responsible for the SIRT (Security and Incident Response Team) - Telmo Santos, by phone to 222 061 597 or via e-mail to fraude@eupago.pt.

Open Banking?

What is it.

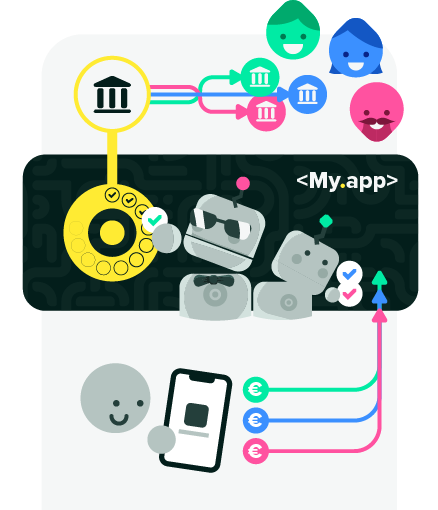

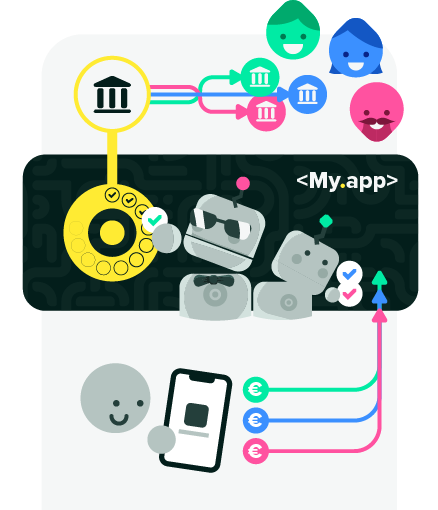

Interact with your bank from another app

Open banking allows for a more dynamic management with your bank. An innovative, secure and more efficient payment service that will offer you a bigger control of your finances.

Two sides.

PSD2 regulates two new payment services: the account information service and the payment initiation service.

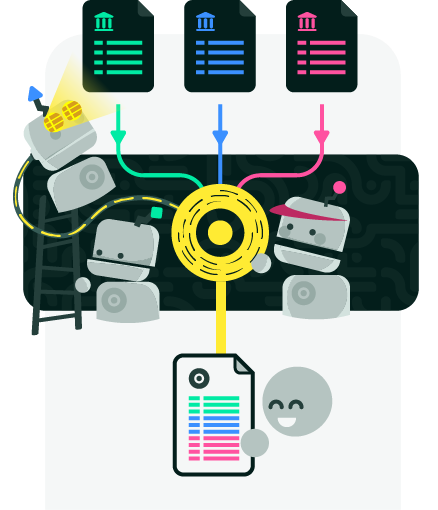

Intelligent integration.

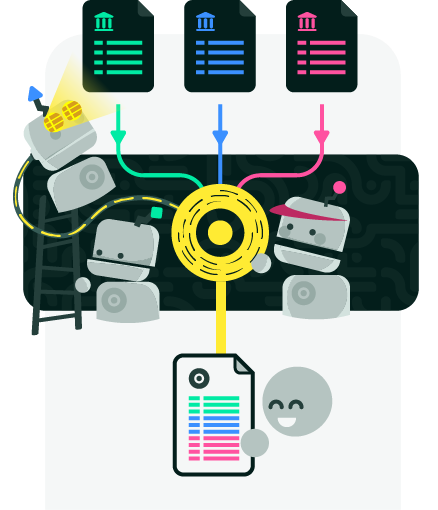

Banking information always accessible

The Account Information Service Provider (AISP) has an overview of your financial situation and accesses your accounts, from one or more banks, through a single app.

License

to pay.

Make payments through your apps

The Payment Initiation Service Provider (PISP) initiates an online payment without having to interact directly with your bank.

Intelligent

Integration.

Bankin information always accessible

AISP means that business can ask for permission to connect to a bank account and use that bank account information to provide a service.

License

to pay.

Make payments from your apps

PISPs are authorised to make payments on behalf of a customer, not only view the data of the account. PISPs initiater transfer directly to or from the payer's bank account using the bank's tools.

EUPAGO - INSTITUIÇÃO DE PAGAMENTO, LDA.

FISCAL DATA

Taxpayer number 513212744

Share capital 1.000.000,00 €

PHONE

00351 22 206 15 97

(Chamada para a rede fixa nacional)

geral@eupago.pt

HEAD OFFICE

Praça Artur Santos Silva 74, 4200-534 Porto (Portugal)

OFFICE

Av. Dr. Prof. Cavaco Silva, Ed. Qualidade B1, 2A

2740-122 Porto Salvo (Portugal)

Other services

No barriers to conversions.

Credit without risks or

counterparts

I want. I can. Eupago.

Integration and mediation of payments

Effortless

conversions.

Credit without risks or counterparts

I want. I can.

I pay.

Integration and Mediation of payments